Budget Tips for Families: How to Cut Household Expenses and Save Money at Home

This post may contain affiliate links. Read the full disclosure

Do you feel like you’re always one step behind when it comes to your family’s finances? If so, you’re not alone. In today’s economy, many families are finding it hard to make ends meet with their household expenses. But there is hope. With a little bit of planning and effort, you can get your family finances back on track.

In this guide, you will learn how to reduce household expenses to save money at home with budgeting tips for families with kids at home.

Budgeting Tips For Families

With kids at home, it can be hard to keep your spending under control. Between school supplies, extracurricular activities, and everyday essentials, costs can add up quickly.

The Australian Bureau of Statistics found that the average Australian household spent approximately $2,083 per week in 2021, which was a 6.5% increase from the prior year and world events have seen this number rise further in 2022.

It’s little wonder that we are all looking for new ways to reduce household expenses and save money at home.

If you’re looking for ways to cut back on your household expenses, here are a few tips to get you started:

Make A Budget

The first step to getting your family’s finances under control is to create a budget.

Sit down with your partner or any other contributing adult house members and figure out what your monthly income is and what your regular expenses are. Once you have a good understanding of your financial situation, you can start making necessary cuts.

While the thought of creating a monthly budget might sound stressful, this is the best way to evaluate your monthly expenses and identify areas you can cut back on your spending. It is also the best way to stay ahead of family finances too.

There are many different ways you can create a household budget:

- A printable budget sheet

- A spreadsheet

- Using a budgeting app

- Or a simple pen and paper budget in a notebook.

Whatever budgeting method you choose, make sure it is one that works for you and your family.

Your goal is to compare your monthly income to your monthly expenses so you can assess what monthly costs you can reduce and what your spending habits look like.

Until we see it all in one place, it can be easy to underestimate our spending habits!

PREPARE YOUR FAMILY BUDGET, SAVE MONEY & GET DEBT-FREE WITH MY BUDGET PLANNER

Communicate With Your Spouse Or Partner

If you are in a relationship, communication is essential for managing family budgets! When it comes to saving money, two heads are better than one.

Talk to your spouse or partner about your financial goals and see if they’re on board with making some changes. If both of you are committed to saving money, it will be easier to stick to your monthly budget and reach your savings goals.

When you aren’t on the same page financially, it will be much harder to cut monthly expenses.

If you’re not in a relationship, talk to other trusted adults in your life about your financial goals. It can be helpful to have someone to bounce ideas off of and help you stay accountable.

Educate Your Kids About Money

One of the best ways to ensure that your family stays on budget is to educate your kids about money matters from an early age.

Teach them the importance of living within their means and explain how income and credit work. Help them understand why it’s important to save for larger purchases instead of buying everything on impulse.

The sooner you start teaching your kids about responsible spending habits, the better off they’ll be financially in the long run. This will also help have them on board when you are looking to make changes to your household spending habits.

Kids who set goals from an early age are more likely to continue this habit into their future.

Encouraging your kids to earn money is a great way to help teach financial skills early. These ideas for how teens can earn their own money are great for when they get older too.

List Of Household Expenses

When creating your household budget, it is useful to have a list of household expenses that most households commonly have. This can help you make sure you are covering the expenses that are less frequent as well, such as insurance policies and registrations.

Here is a list of common monthly expenses to include in your budget:

- Mortgage or rent payments

- Groceries

- Utility bills – water, electricity, gas, rates

- Transportation costs

- Childcare expenses

- Education/school expenses

- Credit card repayments

- Loan repayments

- Subscriptions – film/tv, music, magazines, newspaper, apps.

- Memberships – gym, sports clubs, social clubs

- Insurance – house, car, health, life, pet

- Phone/internet bill

- Entertainment – meals out, movies, theatre tickets

- Clothing

- Gifts

- Donations

- Roadside assistance

- Pet care

- Personal care – haircuts, beauty treatments

- Services – lawn mowing, cleaning, gardening

As you can see, there are a lot of expenses that go into running a household! It is important to track all of these costs so you can get an accurate picture of your finances.

Once you have a good understanding of where your money is going each month, you can start making necessary cuts.

Some of these expenses are annual expenses that need to be accounted into your budget, whether through a savings account or by paying in monthly instalments to help you budget your money.

Where To Start? – How To Reduce Household Expenses

Now that you have a list of your monthly household expenses, it’s time to start making some cuts!

One of the best ways to reduce your expenses is to see where you can make changes in your spending habits. These steps will help you to start cutting costs at home:

1. Start By Evaluating Your Spending Habits

Take a close look at your bank account, statements and credit card bills from the last few months. Where is most of your money going? Is it on necessary expenses like groceries and utility bills, or are you spending a lot on discretionary items like entertainment and dining out?

Once you have a better idea of where your money is going, you can start to make changes in your spending habits. This can sometimes be very confronting since we often don’t consider exactly how much we are spending on non-essentials.

If you find that you are spending a lot on unnecessary expenses, try to cut back on those areas first.

2. Cut Back On Unnecessary Expenses

Are there any expenses that you can reduce or eliminate altogether? The best place to start is by eliminating any expenses you don’t need, such as services you are no longer using.

For example, if you have a gym membership that you never use, now is the time to cancel it. Or streaming services that you never watch. Even saving $10 a month can add up over a year!

Every little bit helps when trying to reduce expenses!

A no spend challenge can be a great way to cut back and kickstart your savings!

3. Find Cheaper Alternatives To Your Regular Expenditures

While many of our monthly expenses are essential, there are often cheaper ways to do the things we do every day without compromising quality or convenience.

This is where you need to do your research and find if there are cheaper services or products for your regular expenses.

Shopping around for household expenses such as insurance policies, phone and internet providers and other services can potentially save you hundreds of dollars a month!

This is something we do regularly in our household when our larger bills are due, such as health insurance or home and auto insurance.

It can be as simple as doing online quotes for other providers to see if they have a better deal available than your current renewal price.

A few things to keep in mind when shopping around is to compare what is included. If you find a cheaper insurance policy for your family, you need to make sure it still covers all the essential services you need. Cheaper is not always better!

You can also make these changes on a smaller scale by choosing generic brands at the grocery store or shopping at budget supermarkets.

4. Negotiate Loan Rates

If you have any outstanding loans, now is a good time to renegotiate your interest rates or consider refinancing your loan through a different provider.

Interest rates can often be negotiated, especially if you have a good history with the lender.

This is something we have done in the past with our mortgage payment when we first became parents and moved to a single-income household. We also fixed a portion of our loan while interest rates were low.

Refinancing debt payments could also help you to reduce your monthly repayments by finding a lender with lower interest rates.

If you are considering refinancing your home loan, make sure to compare all the costs involved as there may be exit fees or other charges that you need to factor in.

A mortgage broker can also help you to compare home loan products from different lenders and find the best deal for your circumstances. They are often free to use (not always) as they take a commission from the service providers instead.

Consolidating your car payment and personal loans with your home loan can often mean a lower rate as well since home loan rates are the most competitive generally.

5. Consider Automating Your Finances

If budgeting isn’t your thing, or if you simply don’t have the time to stay on top of your finances every month, consider automating as much as possible.

The initial set-up can take a little bit of time and you may need to make some adjustments after the first month, but automating your finances can help take some of the work out of saving money.

We do this both as a way of managing our household finances and saving time at home!

For many regular bills, there is an option for direct debit so that the payment is automatically charged to your chosen account. This is a great option so long as you keep enough money in the account for recurring payments.

Another option is to set up your own automated payments.

We do this with a monthly bill pay method where we automatically pay a set amount each week towards our utilities. This means we are always a little ahead and there are no big payments to come out every month or quarter that throw out our budget. Instead, we are paying $30 to $40 per week, which is a much easier amount to budget for.

This is somewhat similar to the Dave Ramsey cash envelopes system but done completely online for the ultimate automation.

6. Start An Emergency Fund

One of the best things you can do for your family’s finances is to start an emergency fund. This is a savings account that you only use in case of unexpected expenses, such as a job loss, medical bills, or home and car repairs.

An emergency fund acts as a buffer between you and debt. It gives you peace of mind knowing that you have the money to cover unexpected expenses without having to put them on a credit card or take out a loan.

The goal is to have at least a month’s worth of income in your safety net fund, but ultimately you want to save as much as possible so that you are covered in case of a major financial setback.

This savings goal might sound daunting, but you can start small and increase your savings each pay as you get closer to your goal.

One of the best ways to save for an emergency fund is to set up a separate savings account and automate your savings. This way you are less likely to be tempted to spend the money on other things.

Consider putting the extra money you saved on reducing your household expenses in steps 2 and 3 into your savings account to jump-start your emergency fund. You may choose to reduce this amount once you meet your emergency goal fund, however, you should always have a portion of each pay going towards savings.

31 Other Ways To Save Money At Home

We’ve covered the higher-level process of how to save money at home and cut family expenses, but there are many other ways you might not have considered that will help you reduce your household expenses.

Use Cash Only

If you struggle to budget for extra spending and entertainment costs, try to pay cash only for these items. This means you will need to budget for these expenses in advance and take out the cash each week or fortnight. Once the money is gone, it’s gone.

This can help prevent overspending as you are more mindful of your spending when you have to part with physical cash.

Re-Evaluate Your Subscriptions

Most of us have several monthly subscriptions – Netflix, Disney+, Spotify, Amazon Music, Audible, fitness apps and magazines to name a few. If you’re not using them, cancel them. There is no point in paying for something that you’re not getting value from.

Please avoid the possibility of unsubscribing from certain services because it seems difficult or is an expense that doesn’t cost much. It all adds up and it’s important to be mindful of where your money is going.

If you are using the service, but not taking full advantage of it, see if there is a lower-priced option that will still give you the value that you’re looking for.

For example, Netflix has different pricing tiers that can save you several dollars a month. Other services have free versions that give you some of the key features and don’t cost a thing.

Pay Annually

Paying annually or semi-annually for services can often save you money. This is especially true for things like health insurance and membership fees.

Some companies will give you a discount for paying upfront and this can be a great way to spend less overall if you can budget for the upfront cost. This will also make your life easier once something is paid for the year.

Cancel Your Credit Cards

If you have a problem with overspending and racking up credit card debt, one way to stop the cycle is to eliminate your credit cards. This might seem like a drastic measure, but it can be very effective in helping you stay on budget.

If you absolutely need a credit card for emergencies, consider cancelling all but one and only using it for true emergencies. Make sure you get rid of any high interest credit cards for a low-interest alternative.

This will help you reduce your expenses and keep your spending in check.

Shop With A List

The easiest way to save on groceries is through the use of a shopping list. By meal planning and creating a grocery list just of the items you need, it will help you to reduce food expenses, minimise food waste and reduce impulse purchases.

Make sure you never do your grocery shopping while hungry! I also find online grocery shopping is another great way to stick to a list and not overspend.

Buy Generic Brands

One of the easiest ways to reduce your grocery bill is to purchase generic brands instead of name brands. In most cases, the generic brand is just as good as the name brand but costs a fraction of the price.

Use Rewards Programs

Many companies offer rewards programs that can help you save money. For example, some supermarkets offer loyalty cards that give you points for every purchase which can be redeemed for money off your groceries.

Some petrol stations have rewards programs where you can earn points to get discounts on fuel. There are also many credit card rewards programs that allow you to earn points which can be redeemed for travel, cash back or merchandise.

By taking advantage of these rewards programs, you can save money on your everyday expenses. The best option is the rewards programs that are free to join and avoid spending just for the sake of points!

Bundle Your Services

Another way to have a lower monthly payment for your monthly expenses is to bundle your services. Many companies offer discounts if you bundle multiple services together. For example, you might be able to get a discount if you bundle your internet and TV services together.

You can also bundle your insurance policies to get a discount. For example, you might be able to get a discount on your car insurance if you also have home insurance with the same company.

Reduce Electricity Use

It’s necessary to heat and chill your house and power your lights and appliances. However, it’s possible to reduce the cost of electricity. Energy costs make up a significant portion of the average monthly budget.

You can reduce these costs by always turning off lights and appliances that are not in use, use energy efficient lightbulbs and considering upgrading to energy-efficient appliances with a high energy star rating.

Adjust Your Thermostat To Reduce Heating/Cooling Costs

Using your household heating and cooling system only when necessary will help you reduce electricity bills, but when you do use it, consider adjusting the temperature.

Canstar Blue has assessed the difference these temperatures can cost on your electricity bill with a guide on ideal temperatures all year round for Australia.

Check Sales & Use Coupons

Reduce your grocery spend by using coupons and shopping sale items when you can. If there are items you use often, it can sometimes be helpful to buy in bulk when they come on sale. Make sure you will use them though.

Consolidate Debt

Credit card debt and high-interest loans can make it difficult to save money. One way to reduce your monthly expenses is to consolidate your debt into one low-interest loan.

This will help you save money on interest payments and potentially pay off your debt faster by combining multiple debts into one interest rate and monthly payment.

Reduce Insurance Premiums

There are many ways to reduce insurance premiums aside from shopping around.

You might be able to reduce your auto insurance premium by increasing your excess. This means you will have to pay more if you make a claim, but it can result in a lower overall premium which will save you a lot over the years, especially if you have no need to claim.

For health insurance, if you’ve finished having kids, it’s likely not worth paying for a premium that covers pregnancy and birth just as a young adult probably doesn’t need hip or knee replacement coverage.

Eat At Home

Cooking food at home can help reduce costs for many people. Weekly meal planning is very useful for saving money on food expenses! Planning your meals also makes you less likely to impulse order takeaway!

Batch Cooking

Making bulk meals for your freezer can sometimes reduce the overall cost per meal expense and this also means saving you time when you’ve got a freezer loaded up with favourite meals for those busy nights during the week.

Check out this huge list of freezer recipe ideas.

Look For Restaurant Discounts

If you do plan to dine out, look at ways you can save by checking the special deals or discounts local restaurants offer such ad kids eat free nights or daily specials.

You can also check sites like Groupon for deals on local restaurants

Order Water Instead Of Other Drinks

Drinks can add a lot to the cost of a meal, so ordering water instead can help you save money. If you’re really craving something other than water, see if the restaurant has any drink specials that may be more affordable than ordering off the regular menu.

Make Your Own Drinks At Home

Instead of buying coffee on the way to work, make your own coffee and use a travel mug.

Carry a bottle of water with you wherever you go so you don’t need to buy bottled water and take your own drinks to places where you are able, such as a day out with friends and family or when heading on a weekend away.

Declutter Your Home

Decluttering your home can save you time and also save you money! It means you are able to find the things you need in your home, so you’re less likely to ‘accidentally’ purchase two or more of something because you didn’t realise what you had hidden amongst your clutter.

When you get into a decluttering habit, it also can be a great way to shift your mindset on what to spend money on!

Carpool To Work

Split the travel costs for a colleague or friend going in the same direction. You could take turns driving so that everyone gets the chance to save money and reduce the wear and tear on their vehicle.

Use Public Transport

Public transportation benefits the environment and sometimes your wallet too! Add in the cost of fuel, parking and maintenance for your car each month, then compare this cost to the cost of public transport.

Sometimes this can reduce your car insurance premiums also if your car spends most of its time in the garage at home.

Set Your Phone To Use Wi-Fi Whenever Possible

While data plans are a lot more flexible these days, you can often get a cheaper plan with a lower data limit. You can use less data by always using Wifi when it is available instead of your phone network data.

This means you won’t run the risk of overusing your data and being charged extra and you might be able to go on a cheaper phone plan or prepaid deal.

Cut Your Cable TV

Avoid spending money when there are viable alternatives. Most streaming services are significantly cheaper than cable TV and you still get great entertainment on demand!

Cut Your Landline

Don’t need a landline phone anymore? Get rid of it. Most households are using only mobile phones these days and the majority of internet services no longer require an active landline so this is a monthly expense that can save you a lot.

Keep Tyres & Vehicles Well-Maintained

A simple check on the tyre pressure will save you money by making your car more economical on fuel consumption. Keeping your car serviced and in good condition means you’re more likely to catch big issues before they arise and can avoid huge repair costs.

Identify Needs Vs Wants When Shopping

When you’re budgeting, it’s important to be able to distinguish between needs and wants. This can help you cut back on spending and save money.

Before you purchase anything out of the ordinary consider if it is necessary – a need, or if it is just something you want and this can help you stop spending money and cut impulse purchases.

Shop At Cheaper Stores Or Warehouse Clubs

There are many budget-friendly stores that sell quality items such as Aldi, Lidl, and Costco. You can often find the same brands that are sold in other stores but at a cheaper price to help you cut costs.

Grow Your Own Food

You can save a lot of money by growing some of your own food at home. This doesn’t mean you need to have a big garden. You can grow herbs and vegetables in pots on a balcony or windowsill.

Use Natural Cleaning Products

Ditch the toxic chemicals that cost a small fortune! You can make your own cleaning products using ingredients that you already have at home. Not only will this save you money, but it’s also better for the environment.

Make Your Own Gifts

If you’re crafty, put your skills to use and make your own gifts instead of buying them from the store. This can save you a lot of money, and the recipient is sure to appreciate the thought and effort that went into their present.

Check out these DIY gifts for Father’s Day, Mother’s Day, Christmas, Valentine’s Day and class gift ideas.

Do A Gift Exchange For Special Occasions

Instead of buying every family member a gift for Christmas or other special events, consider doing a gift exchange.

We do a family Secret Santa each year with both of our families so we only need to buy 2 gifts each instead of the 20+ we would be buying otherwise. We do still get small gifts for the kids in the family, but all the adults participate in the gift exchange.

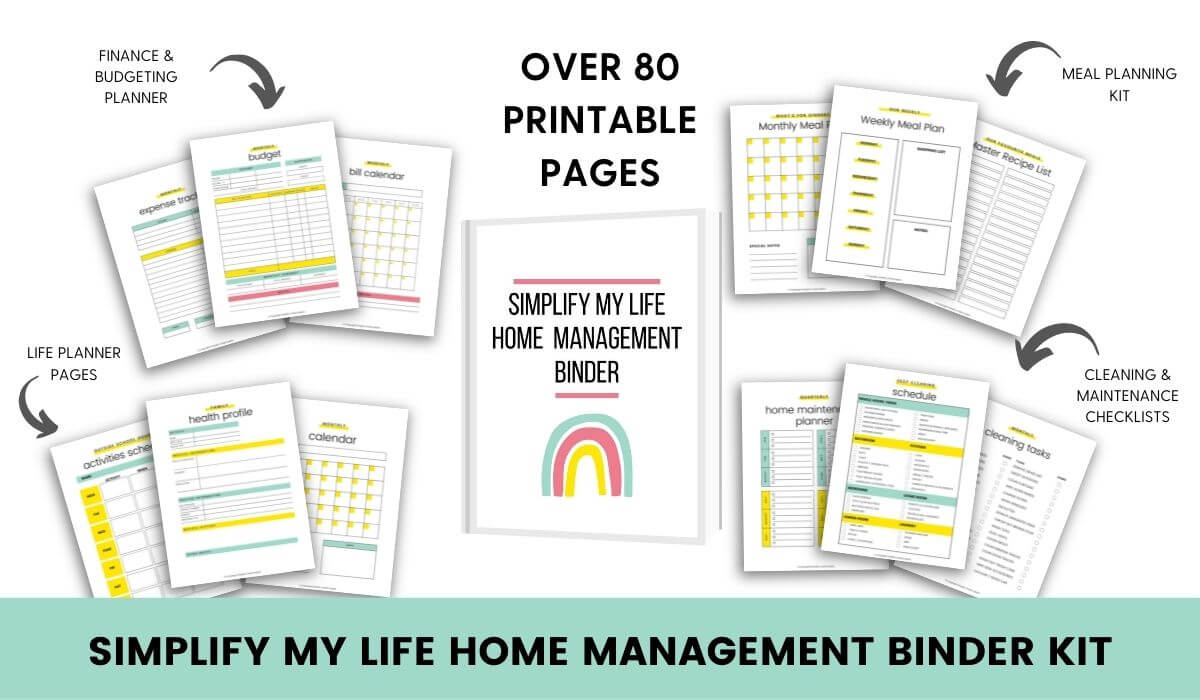

Get my Home Management Binder Printables

With over 80 pages of printables to help you manage your home and your life, this is the perfect way to create your home management binder – without having to make all the pages yourself!

This printable kit is undated so you can use the pages year after year and you can print them as often as you need them or skip a page if it isn’t relevant to you!

It includes all the family budgeting, meal planning, cleaning checklists, life planner, calendars, home maintenance and health pages to help you stay more organised at home!

Saving money doesn’t have to be difficult—sometimes, all it takes is a little bit of planning and effort. By evaluating managing how you spend money, looking for ways to cut expenses, and finding cheaper alternatives to regular expenditures, you can easily save hundreds of dollars each month. And if budgeting isn’t your thing, consider automating as much of the process as possible. Taking these steps can help stretch your family’s budget further and ease some of the financial pressures that come with raising kids.

These are such clever tips Holly! I’m a terrible waster, I really need to pull things in a bit!

Thanks Rach. My hubby is pretty bad at this stuff. I’m always telling him off & turning things off on him haha

Excellent tips! I’m not as good at this as I could be even though I know this! #mummymondays

Sometimes we like our home comforts too much to cut back ?