Are you ready to get on top of your life and tick the big things off your to-do list? Getting your life organised is super satisfying – and these life admin tasks are here to help you feel more organised and less stressed.

You will also have tips on planning your own life admin day and how to create your personal life admin checklist for making the most of this time.

Why Is Life Admin So Important?

In an ideal world, we’d all have virtual assistants that efficiently take care of our life admin for us.

In the real world, most of us carry around a rather long list of tasks that we put off – week in, week out.

Sound familiar?

I know I could quite easily have a Master’s degree in procrastination at times! But it’s time to shake that off!

According to a RAND study, the average person has around five hours of free time each day – which is typically swallowed up in front of the TV, listening to the radio, reading – or scrolling social media!

Imagine if you took just half an hour of that time each day and spent it on your life admin to-do list? You would work through it in no time!

RELATED READING: 31 legitimate work at home job ideas for mums

Plan A Monthly Life Admin Day

One of the best things I have been doing in recent years is having monthly life admin days. I book these out in my planner ahead of time and adjust them if something comes up, however, I do make sure they always happen.

This is a great way to tackle all your non-urgent life admin to do list tasks that might not need to happen today but are still very important.

On these days I book appointments, organise documents, policies and bills and focus on any other things that will help with organising my life and my family life.

The system that works best for me is adding to my life admin checklist throughout the month so that when the day arrives I know exactly what I need to do. I also add tasks such as items that need replacing.

This means I get it done quickly and often have time to spend the rest of the day focusing on deep cleaning or scheduled cleaning tasks around the house.

You can also incorporate your life admin tasks into a weekly reset or monthly reset routine instead.

Life Admin Tasks To Organise Your Life

Becoming the master of your own life need not be overwhelming.

Breaking your list down into manageable life admin tasks is the first step.

Best of all, once many of these tasks are completed the first time, it takes little time to maintain them, which is perfect when you are looking for how to organise your life and get back more time!

To help get you started, we’ve compiled a list of our top 10 life admin checklist tasks that will help you really transform how organised you feel.

1. Write or Update Your Will

No one likes to think about dying, but there is no getting around the fact that it happens to us all.

To protect your loved ones, it is important to leave financial and guardian instructions in a legal document.

Try to review your will annually and update it to reflect your current situation.

It can also be helpful to put together a document or folder of essential information to pass on to the family in the unfortunate case something did happen to you. This is something I have done both for personal life and work, since being self-employed means having a rather non-conventional set-up. For this reason, I have created a business succession plan for my husband, just in case.

2. Update your Insurance policies

Review and update your Life Insurance, Income Protection, Car and Health Insurance covers.

Many people automatically renew their insurance each year without scrutinising the details – even though their circumstances may have changed.

It can pay to shop around for a better deal on your regular household expenses too.

Quite often you can save a lot of money by shopping around, rather than simply accepting the annual increase in your existing policy.

And in a lot of cases, this can also mean extra benefits your existing cover may not have had.

3. Create a household budget

Take a close look at how much you are spending on telecommunications and energy bills.

Growing families have growing needs, and with costs rising all the time you might want to consider alternative providers.

And don’t be shy about calling up your current provider and asking for a better deal, especially if you have been loyal for a period of time. They want to keep your business!

It is essential to have a household budget in place. If you don’t have one already, this is something that is best done with your partner or other contributing household members.

A budget can be a simple written tracker of expenses and income or you can set up a spreadsheet that auto calculates based on the figures you enter. There are also many different budgeting apps that may suit your family.

What you use is up to you, so long as you have something in place.

This will help you to avoid unexpected expenses and ensure you have the ability to save money and set yourself up a financial safety net of savings.

PREPARE YOUR FAMILY BUDGET, SAVE MONEY & GET DEBT-FREE WITH MY BUDGET PLANNER

4. Declutter your inbox

A quick digital cleanse can feel as liberating as clearing your desk of paperwork.

Sit down and sort through your emails, filing important correspondence and responding to any outstanding personal emails.

It reduces the chance of wasting time trying to find something amongst the mess too.

This will also help you zero out your inbox quickly each day to avoid it getting out of control again.

The best place to start is by considering the type of emails you like to keep and setting up a folder for each of these.

Some examples might be – Bills & Expenses, School, Travel, and Invoices.

5. Reevaluate your loans

Even a slightly lower interest rate could potentially save you hundreds of dollars a year and thousands over the life of your home loan or other existing loans.

You may want to consider switching home loan products – it could help you to pay off your mortgage earlier or again, negotiate a better rate with your provider.

If you have more than one loan, it might be beneficial to consolidate them into one low interest option.

It is often much easier to get a better deal with the provider you are currently borrowing from than it is to take your business elsewhere.

Always research first and then approach your provider with comparisons to see if they will match it or beat it.

The Barefoot Investor, Scott Pape, provides great scripts and guides in his book for negotiating better rates with your existing policyholders and loan providers.

6. Take a look at your personal banking

Have you got bank accounts or credit cards sitting unused? It might be time to close them.

Or, you could look at your banking products to make sure you are getting the best deal and not spending more than you should on bank fees and interest.

Consider no annual fee credit cards and bank accounts with no service or ATM fees.

Another worthwhile option to consider is whether you have a great rate on your high interest savings account or if there is an alternative zero-fee option that will help you boost your savings faster.

7. Organise your tax documents

Find, sort and file deductible receipts, Group Certificates and tax statements.

For fellow Aussies, the Australian Taxation Office has an app you can use to help keep track of your deductible expenses. There are many other tools and systems available through your government taxation body or by using basic accounting software if your tax files are more complex.

Doing it now means no scramble at tax time!

8. Understand your superannuation

Check whether you have any past super funds you have forgotten about and, if you do, consolidate them into one.

Review your investment options and use a comparative website like Canstar to see how your fund stacks up against its competitors.

9. Sort important documents

Now you’ve sorted through your paperwork be sure to file all your investment details, insurance covers, will, house deeds and banking in a logical way – so that not only you know where to find it, but your nearest and dearest can, too, should the need arise.

Set up a filing system or use some simple folders for storing your important paperwork.

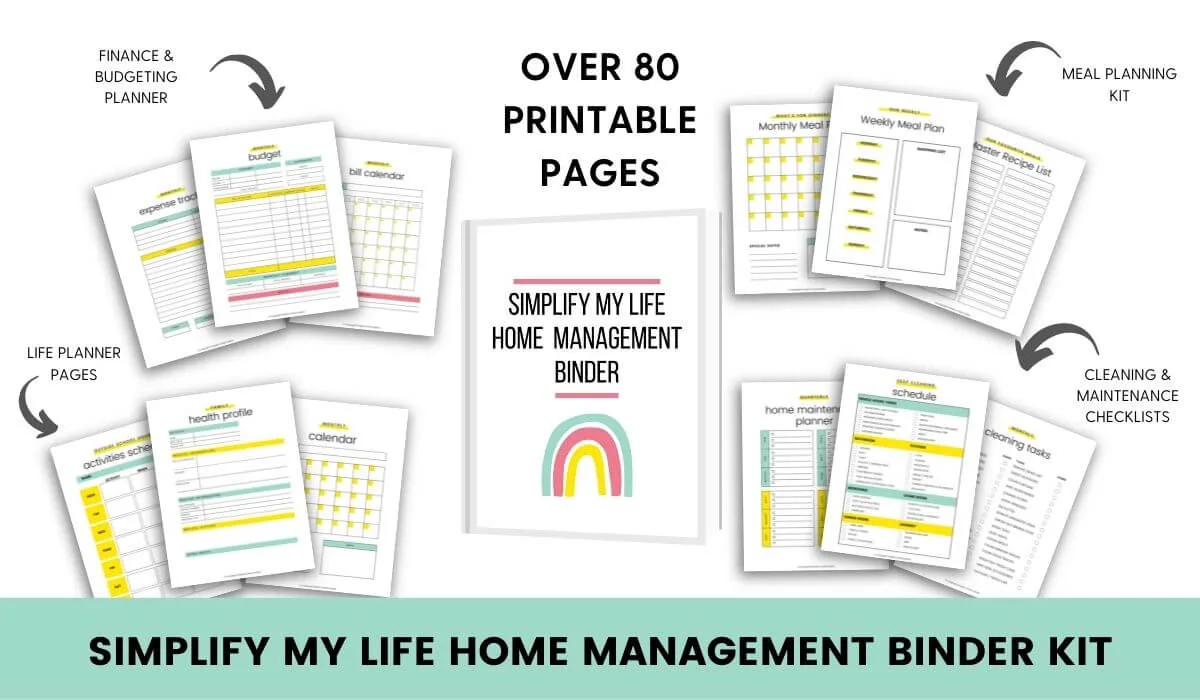

A home management binder can be another great option for keeping all your important information together. Follow my guide to create your own, or save time and get my printable bundle below instead.

10. Schedule the appointments you have been avoiding

Time to book in all those important appointments you have been procrastinating on!

You know the ones: your annual medical and dental check-ups and the car service.

Then relax and book yourself a massage: you’ve earned it.

Remember, the more time you give yourself to do something, the more time it takes.

To increase efficiency, set time limits for each of your tasks – and stick to them. Free of distraction means you are focused on the task and not what your friend just posted on Facebook!

Weekly Life Admin Tasks

While there are some tasks that need to be done once and reviewed annually or quarterly, there are other tasks that will help you organise your life that are more regular.

Some examples of these include meal planning, cleaning your home and planning for the week ahead.

I like to set aside an hour each Sunday night (or Monday morning if my weekend is busy) to plan for the week ahead.

This means planning our family meals for the week and doing up our grocery list as well as blocking out my planner calendar with any important activities and appointments.

Once you can see how your week looks, you can add in other important tasks such as when you will do cleaning tasks or when you want to fit in a workout or social activities.

This helps to make the week feel much calmer going into it with a plan!

To help you stay on top of your life management plans, consider making your own home management binder.

To help save you time, I have a mammoth printable homemaking binder kit with everything from finances, to meal planning, emergency contact info and home maintenance, family schedules and so much more included:

Get my Home Management Binder Printables

With over 80 pages of printables to help you manage your home and your life, this is the perfect way to create your home management binder – without having to make all the pages yourself!

This printable kit is undated so you can use the pages year after year and you can print them as often as you need them or skip a page if it isn’t relevant to you!

It includes all the family budgeting, meal planning, cleaning checklists, life planner, calendars, home maintenance and health pages to help you stay more organised at home!

These life admin tasks will help you create your own life admin checklist so that you can stay on top of those tasks you don’t enjoy doing. Having a plan in place to tackle these items will help you organise your life and keep it organised!

For more tips to organise your life:

- Best planners for busy women

- Meal planning for busy households

- DIY family command station ideas

- How to get started with using a planner

- Cleaning hacks you should know

- Tips for reducing cleaning time

- How to create a cleaning schedule

- How to speed clean your home

- Spring cleaning checklist for your home

- 30-day declutter challenge

- How to lower stress in your life

- Tips for creating a morning routine with kids

- Easy ways to simplify your life